There are lots of Lottery contests out there with varying odds. But consider a typical, popular Lottery, the Powerball, for a moment. The odds of winning the jackpot are around 1 in 292.2 Million. When the jackpots grow in size, the market floods with people who want to buy lottery tickets. When the jackpot is low, fewer people play.

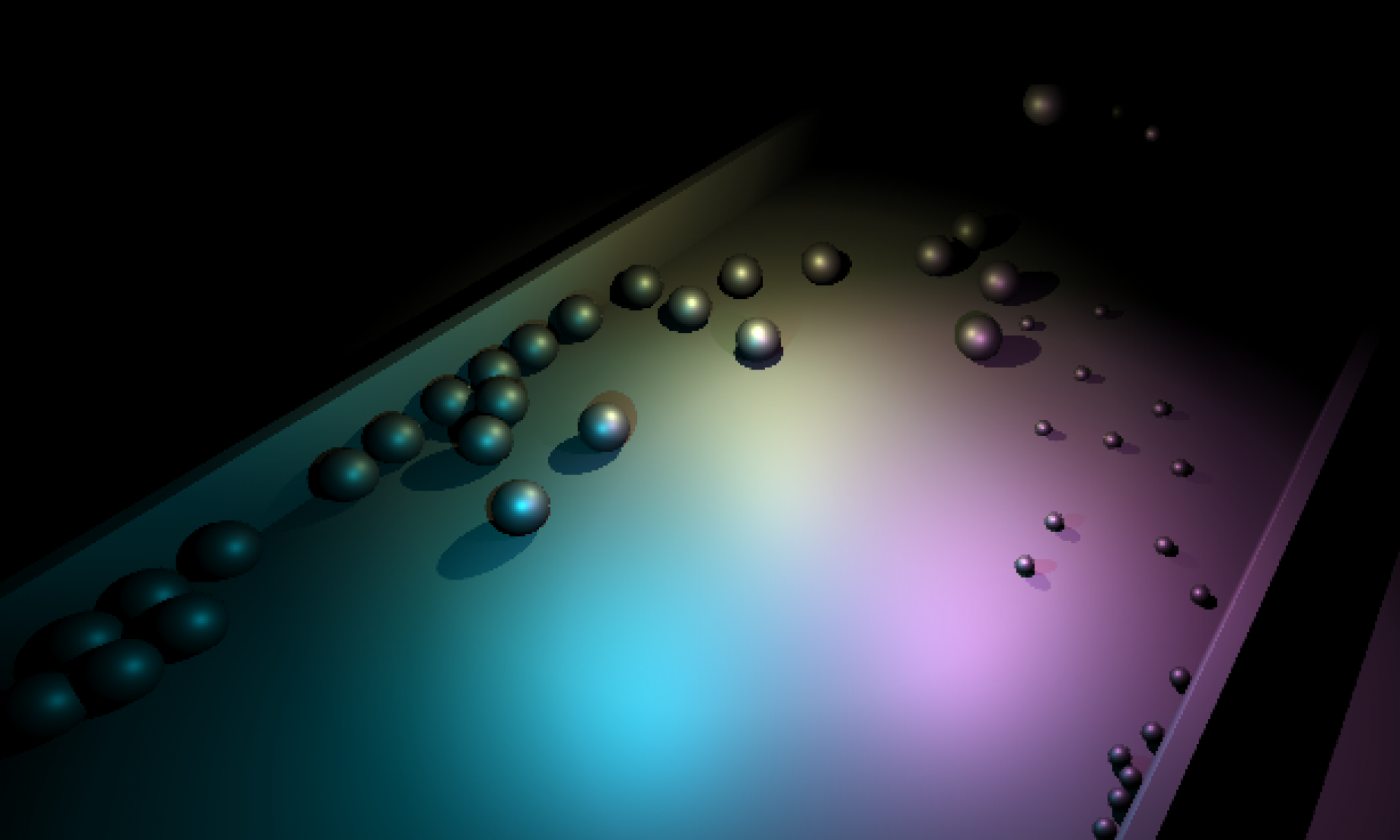

The market ebbs and flows because the winnings vary. This is a simple market force. But what if we designed a different kind of lottery, one with a FIXED, MASSIVE jackpot of say… $1 billion dollars… however as a catch, we set it up so that as more people played it, the more numbers you had to match… decreasing your odds of winning.

Clearly if only a few people played this billion dollar lottery, your chances of getting a return on your investment would be very high and your incentive to buy lottery tickets would also be high, potentially causing you to put all your money into trying to win it.

But the real question I ask you to ponder is… over time, what is your expected ROI in this design? You buy $1 worth of lottery tickets, how much do you expect to get back?

Continue reading “Why “Chia” will never be more “Green” than Bitcoin”